39 zero coupon bond benefits

VVIP Escort - Aerocity Escorts & Escort Service in Aerocity Aerocity Escorts & Escort Service in Aerocity @ vvipescort.com. Escort Service in Aerocity @ 9831443300 Provides the best Escorts in Aerocity & Call Girls in Aerocity by her Aerocity Escorts, Housewife, Airhostess, Models and Independent Aerocity Call Girls. Call us 24X7 @ 9831443300 for No.1 and cheap Escort Service in Aerocity, and have a collection of hot, sexy high profile … Microsoft is building an Xbox mobile gaming store to take on … 19.10.2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

Publication 550 (2021), Investment Income and Expenses Form 1099-INT for U.S. savings bond interest. When you cash a bond, the bank or other payer that redeems it must give you a Form 1099-INT if the interest part of the payment you receive is $10 or more. Box 3 of your Form 1099-INT should show the interest as the difference between the amount you received and the amount paid for the bond. However ...

Zero coupon bond benefits

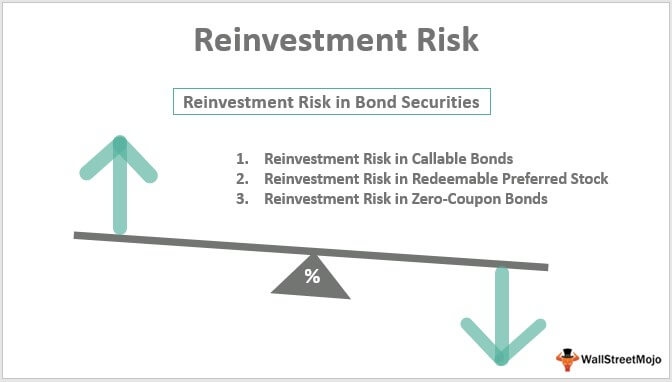

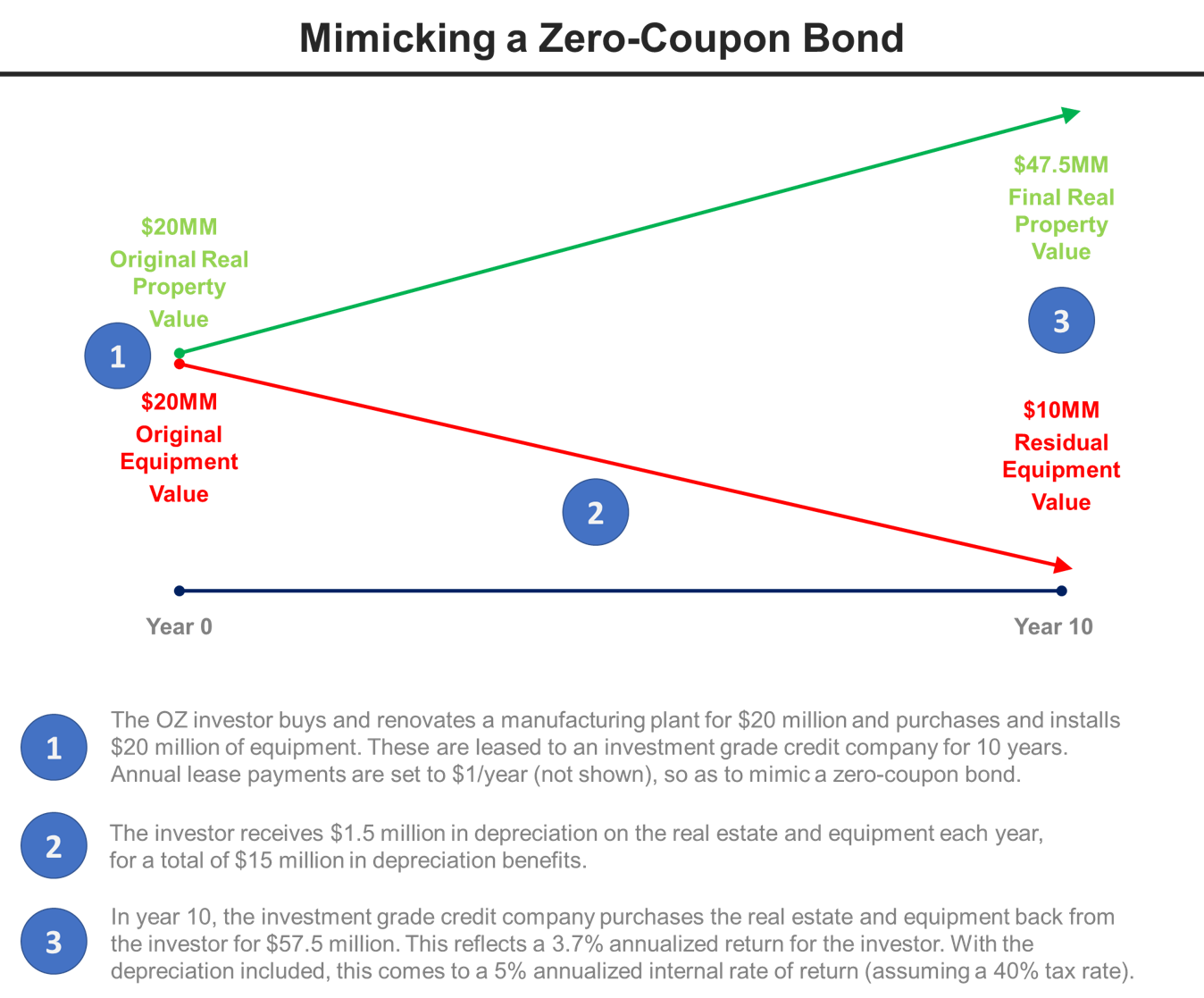

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? 31.08.2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. What Is a Bond Coupon? - The Balance 04.03.2021 · The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest payments. Zero-coupon bonds don't pay interest. They instead mature to a value greater than the principal investment. Zero-Coupon Bond - Wall Street Prep Once a zero-coupon bond matures and “comes due,” the investor receives one lump sum payment inclusive of: Original Principal; Accrued Interest; Bond Quotes . A bond quote is the current price at which a bond is trading, expressed as a percentage of the par value. For example, a bond priced at $900 with a par value of $1,000 is trading at 90% of its face value, …

Zero coupon bond benefits. Zero Coupon Bond Calculator – What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds. Zero coupon bonds have a duration equal to their time until maturity, … Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Outlook – free personal email and calendar from Microsoft Get free Outlook email and calendar, plus Office Online apps like Word, Excel and PowerPoint. Sign in to access your Outlook, Hotmail or Live email account. Zero-Coupon Bond - Wall Street Prep Once a zero-coupon bond matures and “comes due,” the investor receives one lump sum payment inclusive of: Original Principal; Accrued Interest; Bond Quotes . A bond quote is the current price at which a bond is trading, expressed as a percentage of the par value. For example, a bond priced at $900 with a par value of $1,000 is trading at 90% of its face value, …

What Is a Bond Coupon? - The Balance 04.03.2021 · The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest payments. Zero-coupon bonds don't pay interest. They instead mature to a value greater than the principal investment. Coupon Bond Vs. Zero Coupon Bond: What's the Difference? 31.08.2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity.

:max_bytes(150000):strip_icc()/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 zero coupon bond benefits"