41 zero coupon bond price calculation

› terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Although a bond's coupon rate is fixed, the price of a bond sold in secondary markets can fluctuate. ... the yield calculation used is a yield to ... How to Calculate Yield to Maturity of a Zero ...

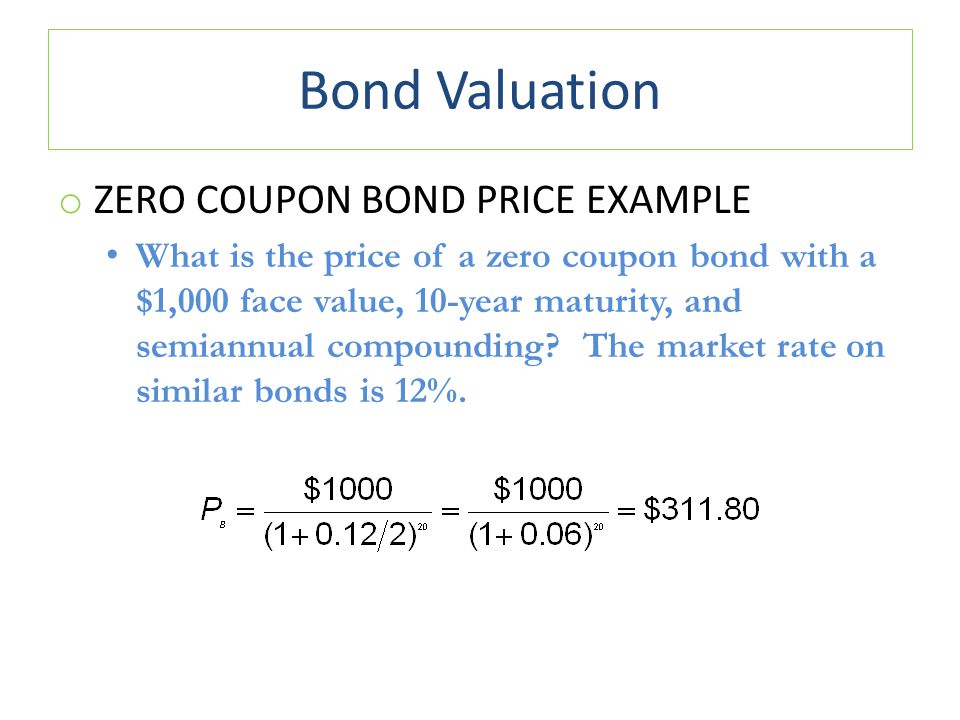

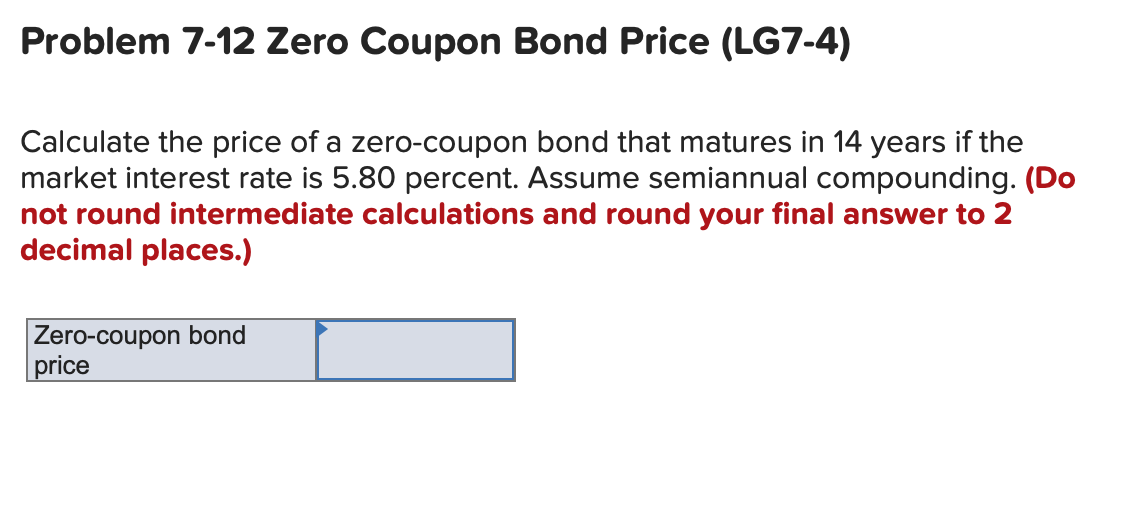

› knowledge › zero-coupon-bondZero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Price Example Calculation. In our illustrative scenario, let’s say that you’re considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions. Face Value (FV) = $1,000; Number of Years to Maturity = 10 Years; Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0%

Zero coupon bond price calculation

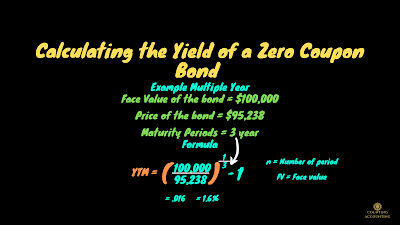

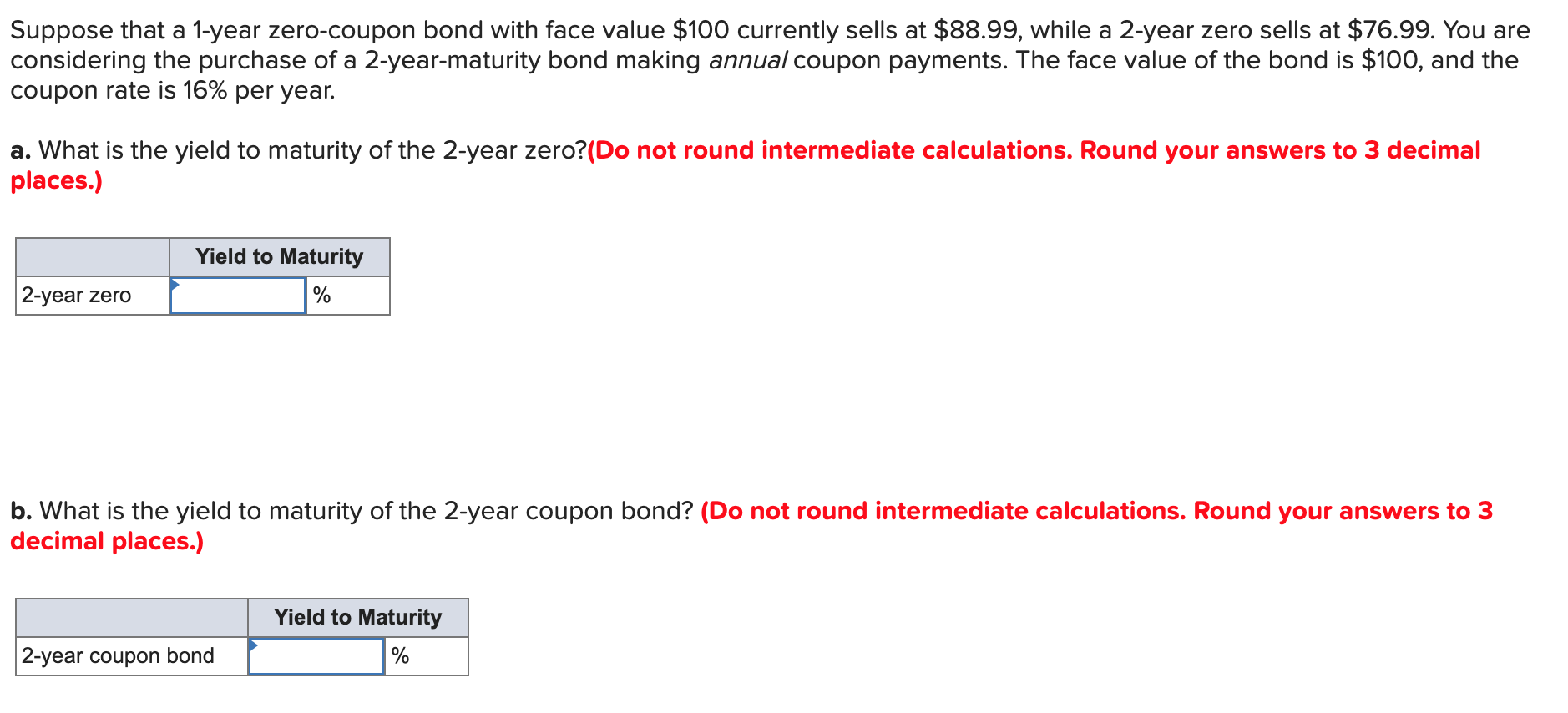

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Bond Pricing Formula | How to Calculate Bond Price? | Examples The price of the bond calculation using the above formula as, Bond price; ... Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market rate of interest is 10%. Hence, the price of the bond calculation using the above formula as, ... en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia Consider first a $100 investment in each, which makes sense for the three bonds (the coupon bond, the annuity, the zero-coupon bond - it does not make sense for the interest rate swap for which there is no initial investment). Modified duration is a useful measure to compare interest rate sensitivity across the three.

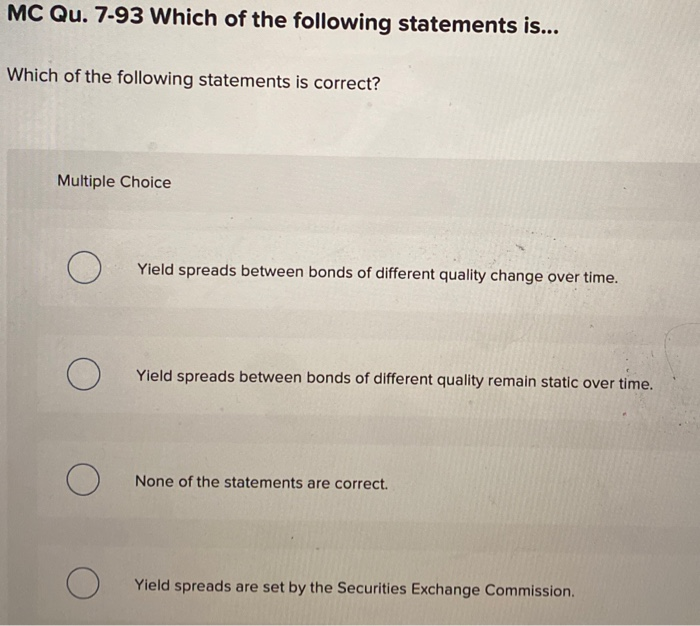

Zero coupon bond price calculation. › terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Oct 11, 2022 · NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia Consider first a $100 investment in each, which makes sense for the three bonds (the coupon bond, the annuity, the zero-coupon bond - it does not make sense for the interest rate swap for which there is no initial investment). Modified duration is a useful measure to compare interest rate sensitivity across the three. Bond Pricing Formula | How to Calculate Bond Price? | Examples The price of the bond calculation using the above formula as, Bond price; ... Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market rate of interest is 10%. Hence, the price of the bond calculation using the above formula as, ...

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 zero coupon bond price calculation"