45 coupon rate vs ytm

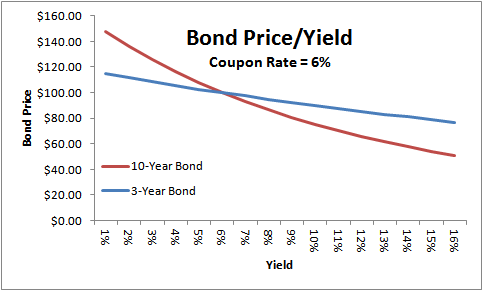

Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Now, what if you bought the security in the secondary market? Perpetuity: Formula and Financial Calculator - Wall Street Prep The denominator is equal to the discount rate subtracted by the growth rate. Present Value of Growing Perpetuity = $102 / (10% – 2%) = $1,275 From our example, we can see the positive impact that growth has on the value of a perpetuity, as the present value of the growing perpetuity is $275 more than that of the zero-growth perpetuity.

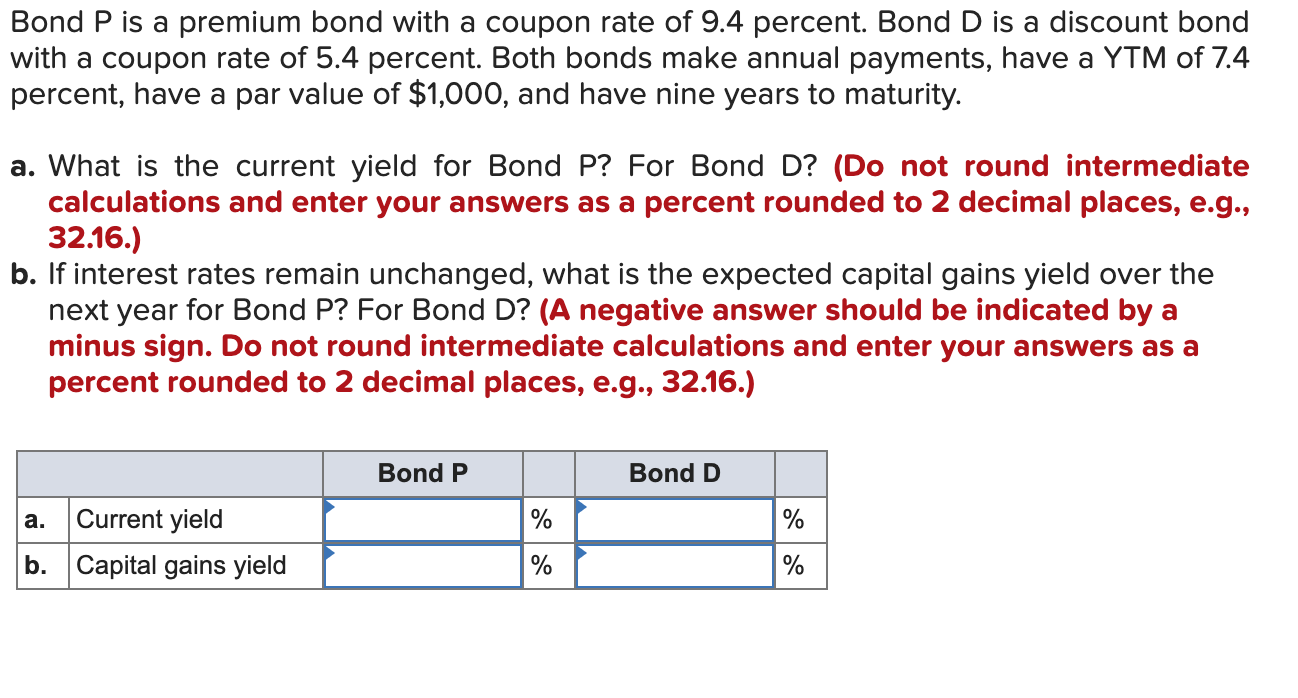

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Coupon rate vs ytm

Coupon Rate Vs YTM - YouTube Learn more about the difference between a coupon rate and a yield to maturity.Investor's Business Daily has been helping people invest smarter results by pro... Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We also explain the difference between the face value and the market value of the bond and their relationship to the coupon rate, current yield, and yield to maturity (YTM). We go through examples... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

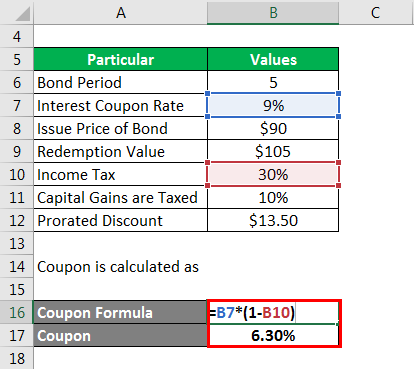

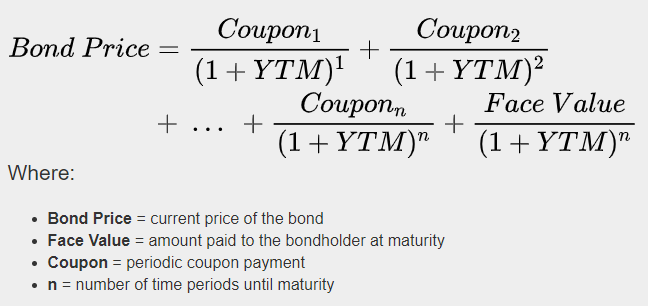

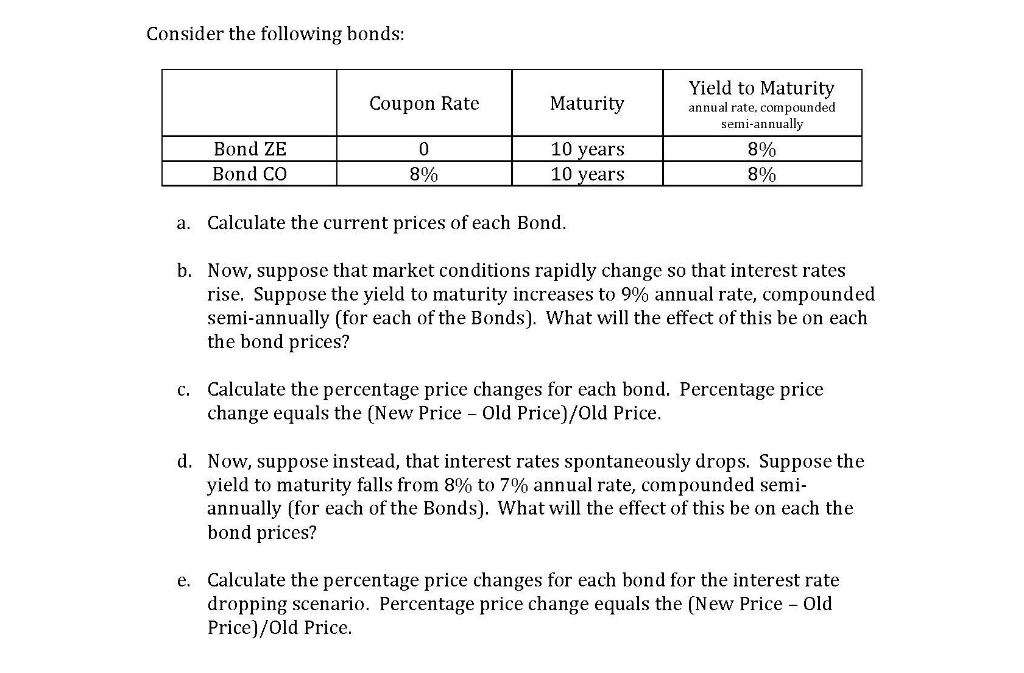

Coupon rate vs ytm. Original Issue Discount (OID): Formula and Calculator - Wall Street … OIDs and Interest Rate Environment. Companies seeking to raise debt capital in a high-interest rate market could be hesitant given the risk of being stuck with high-interest expense payments over a long period. If interest rates were to decline later, the high-interest rate bonds – i.e. priced above-market – could soon burden the issuer. Coupon Rate Vs Current Yield Vs Yield To Maturity Ytm Explained With ... The yield to maturity (ytm) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. coupon vs. yield infographic let's see the top differences between coupon vs. yield. Ppt Interest Rates And Bond Valuation Powerpoint Presentation Id 242353 Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : 9 Bond Formula | How to Calculate a Bond - EDUCBA Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

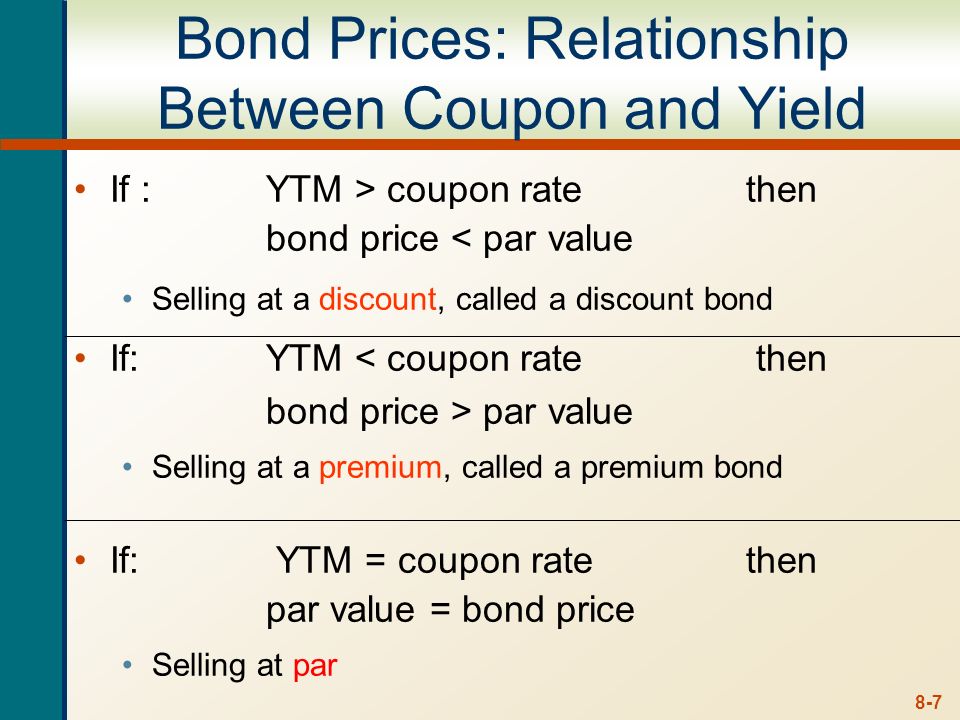

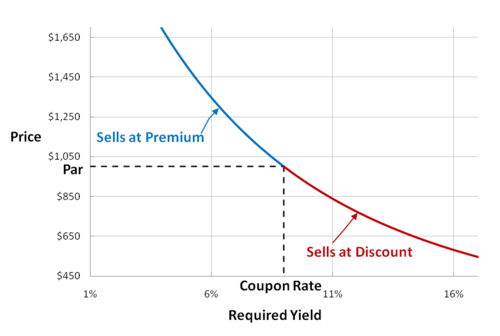

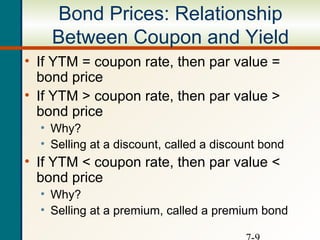

Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Yield to Maturity Calculator | Calculate YTM Jul 14, 2022 · Calculate the YTM; The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: cf - Cash flows, i.e., coupons or the ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference. Equity vs Fixed Income - A Side by Side Comparison 04/02/2022 · The yield-to-maturity (YTM), is the single discount rate that matches the present value of the bond’s cash flows to the bond’s price. YTM is best used as an alternative way to quote a bond’s price. For a bond with annual coupon rate c% and T years to maturity, the YTM (y) is given by: Macaulay Duration (D), and subsequently Modified Duration (D*), are used to … Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Yield to Maturity (YTM) - Overview, Formula, and Importance 07/05/2022 · Yield to Maturity (YTM) – otherwise referred to as redemption or book yield – is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and …

Yield To Maturity(YTM): Meaning & Coupon Rate Vs YTM Vs Current Yield ... Coupon Rate Vs YTM Vs Current Yield. Before we move further, let us understand that when you purchase a bond, there are three things that are fixed, given below with examples-1.Face Value- Rs 1000. 2.Coupon Rate- 8%. 3.Maturity Period- 5 years. Yields can be measured in multiple ways, out of which 3 most common measures are-

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. Coupon Payment Frequency - How often the bond pays out interest every year. Calculator Outputs. Yield to Maturity (%): The yield you'd recognize holding the bond until maturity (assuming you receive all payments). Macaulay Duration (Years) - Weighted average time (in years) for a payout from the …

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

consider a coupon bond that has a 900 par value and a coupon rate of 6 the bond is currently selling

Yield to maturity - Wikipedia Coupon rate vs. YTM and parity. If a bond's coupon rate is less than its YTM, then the bond is selling at a discount. ... Formula for yield to maturity for zero-coupon bonds = Example 1. Consider a 30-year zero-coupon bond with a face ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We also explain the difference between the face value and the market value of the bond and their relationship to the coupon rate, current yield, and yield to maturity (YTM). We go through examples...

Coupon Rate Vs YTM - YouTube Learn more about the difference between a coupon rate and a yield to maturity.Investor's Business Daily has been helping people invest smarter results by pro...

![Solved] 2)Colliers Concord Ltd. has recently issued a bond ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/24859591.jpg)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "45 coupon rate vs ytm"