38 present value of zero coupon bond calculator

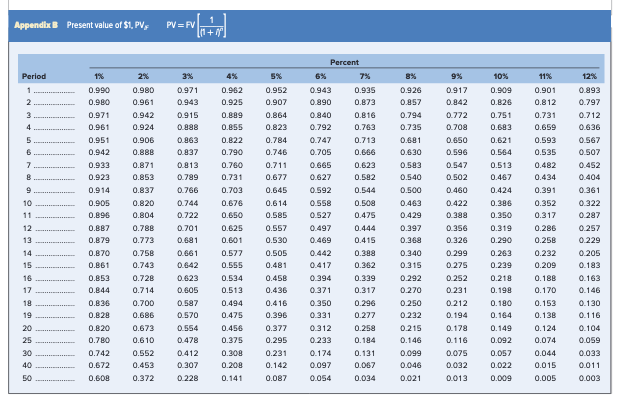

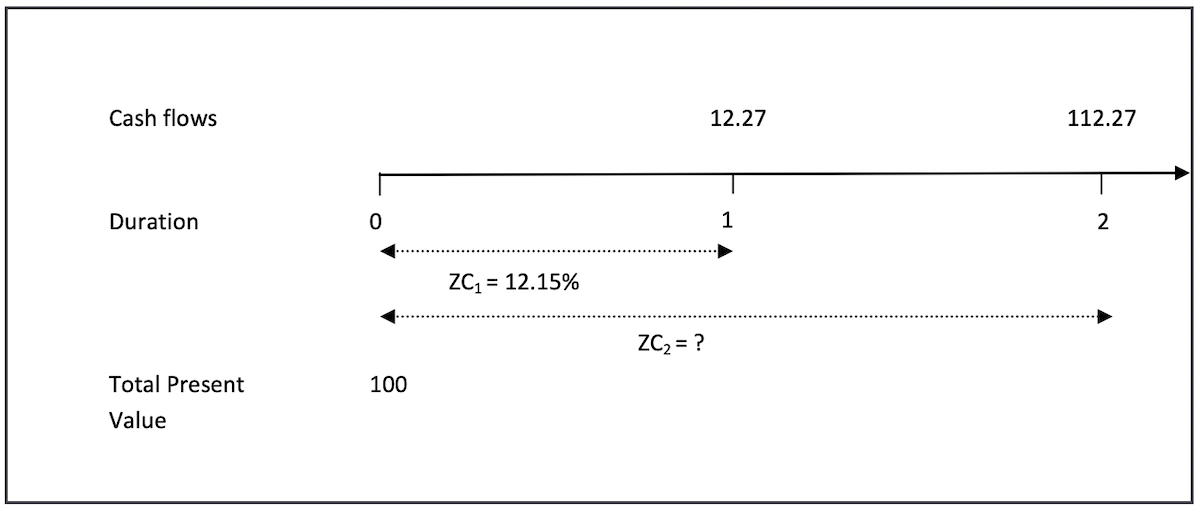

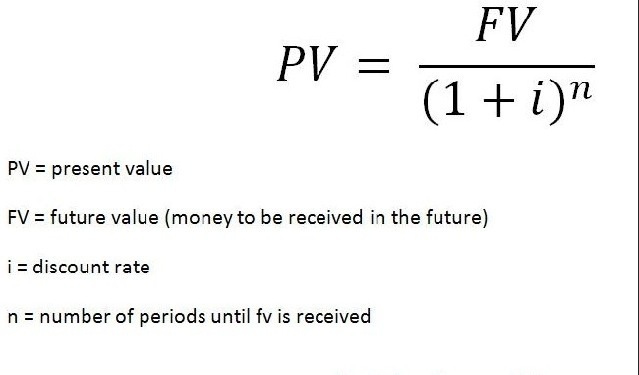

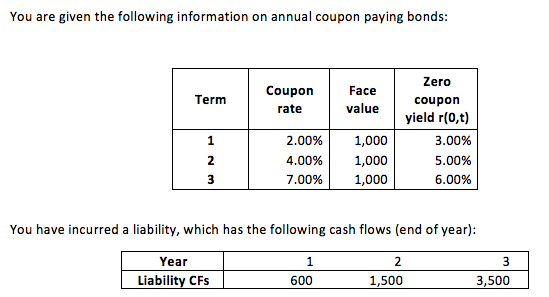

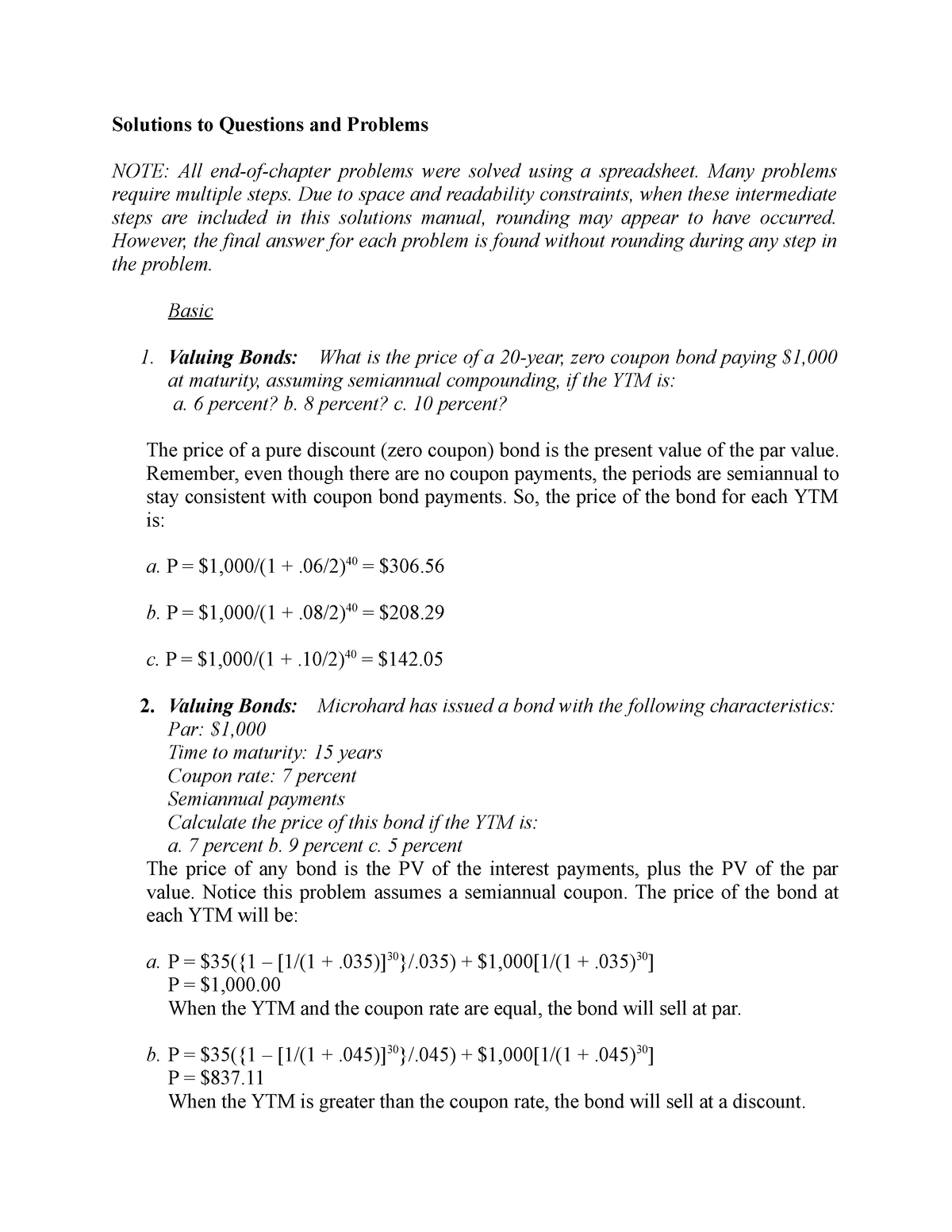

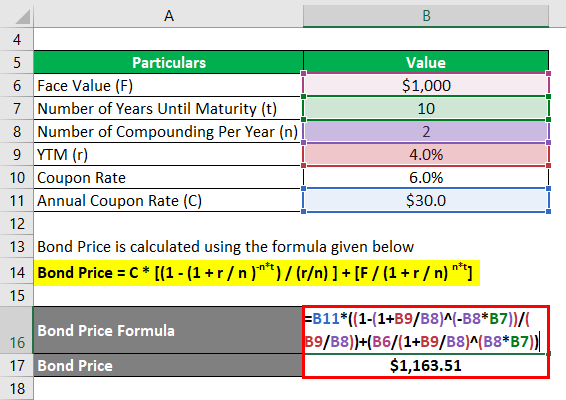

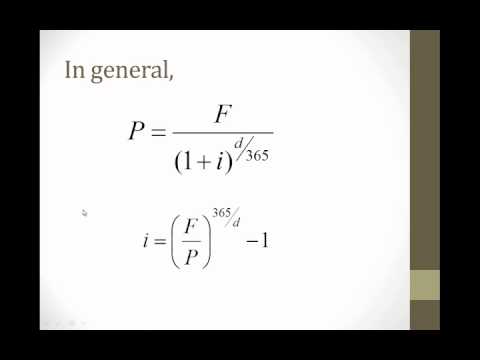

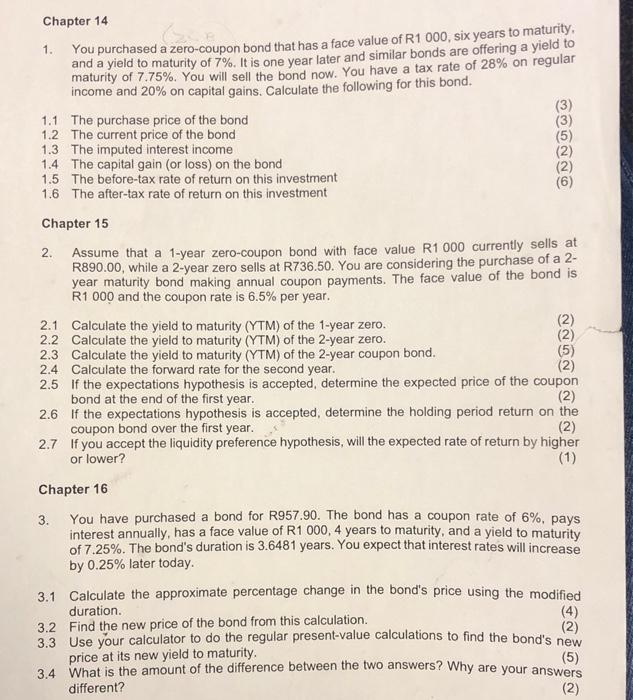

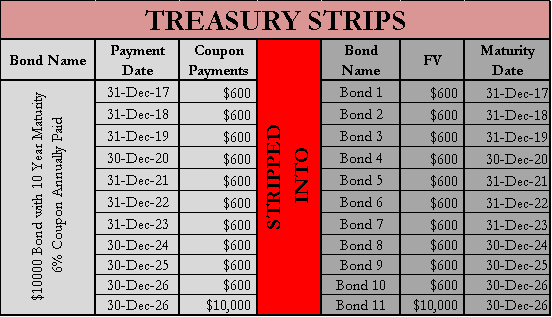

Present Value Calculator The present value formula is PV=FV/ (1+i) n, where you divide the future value FV by a factor of 1 + i for each period between present and future dates. Input these numbers in the present value calculator for the PV calculation: The future value sum FV. Number of time periods (years) t, which is n in the formula. Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

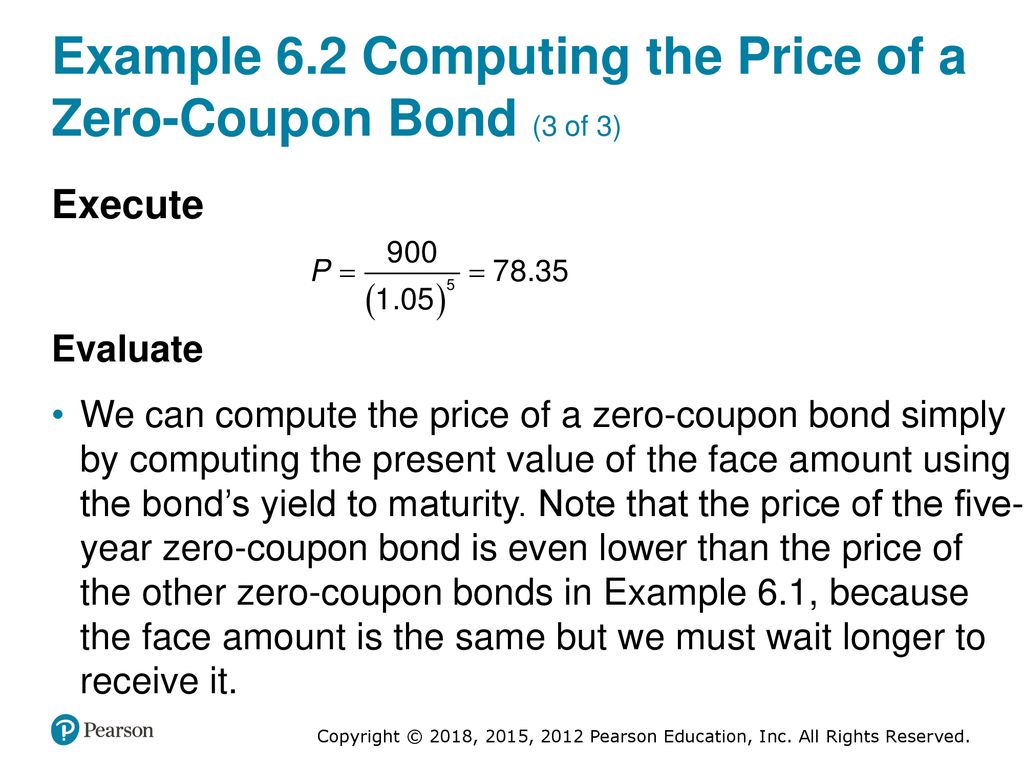

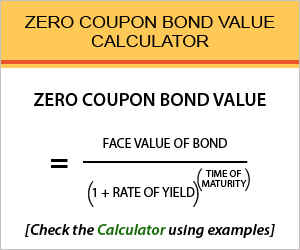

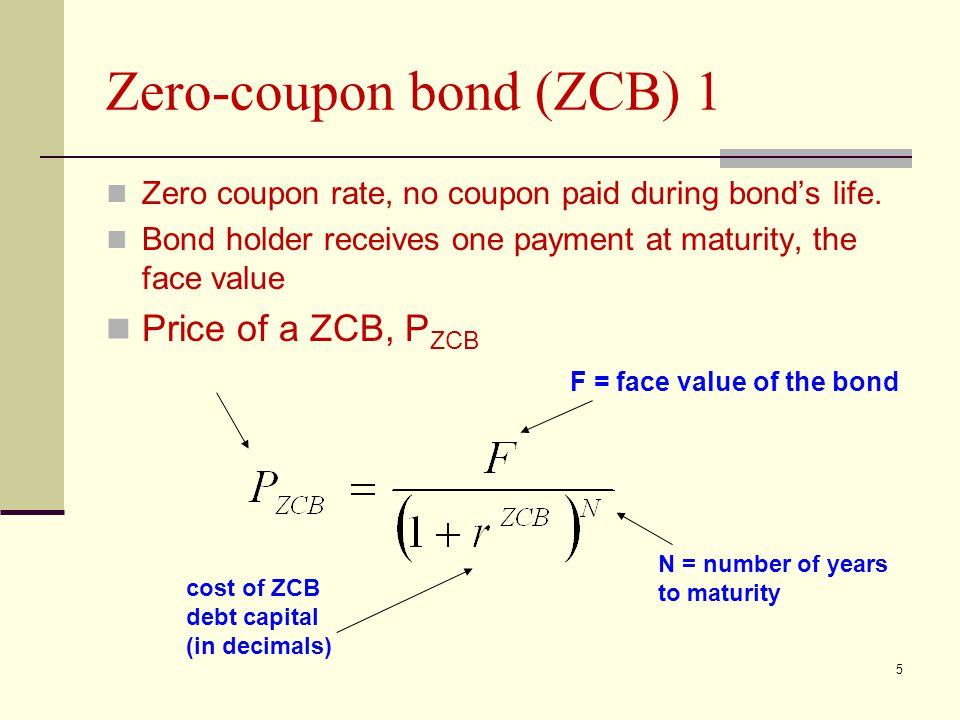

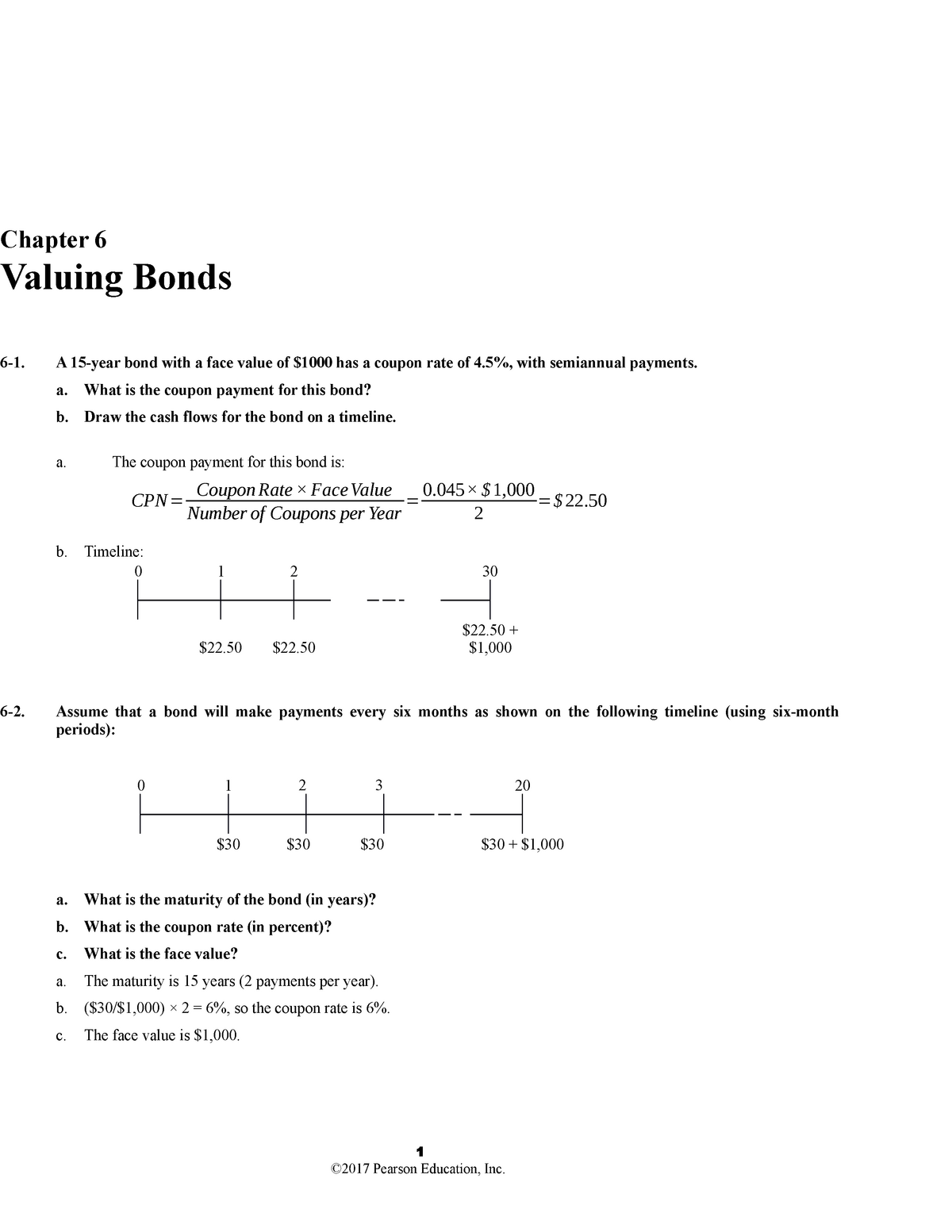

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula P = M / (1+r)n variable definitions: P = price M = maturity value r = annual yield divided by 2 n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term.

Present value of zero coupon bond calculator

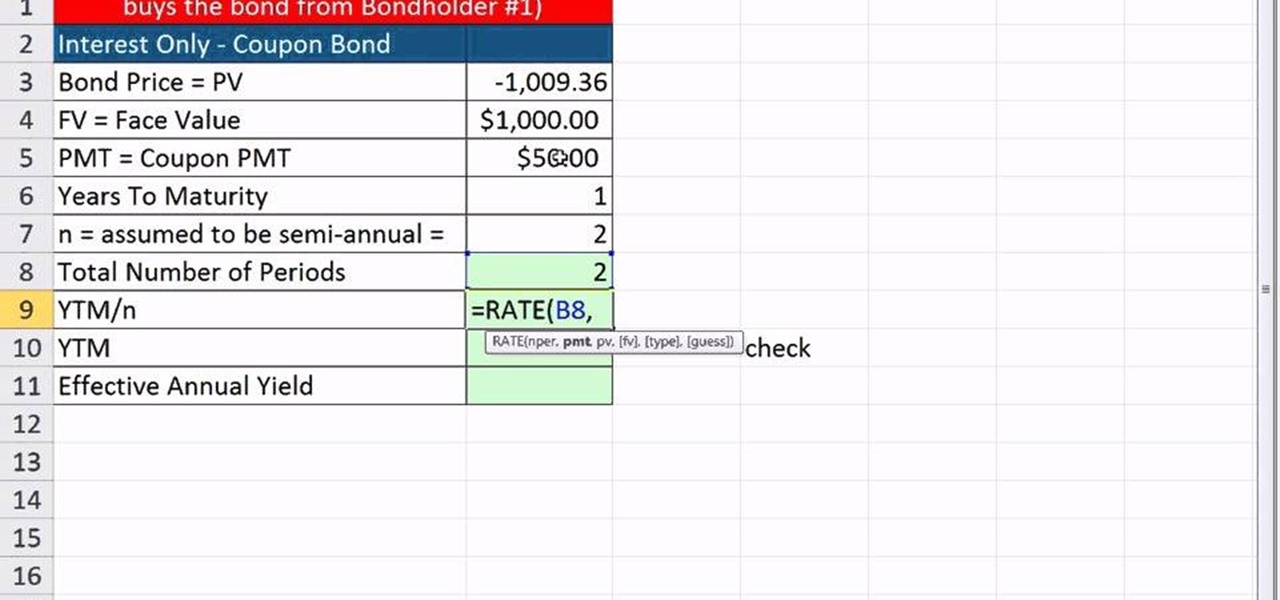

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317 How to Calculate Bond Price in Excel (4 Simple Ways) Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples) Method 2: Calculating Bond Price Using Excel PV Function Zero Coupon Bond Calculator - Nerd Counter If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). PV = PVT = Face Value (1+r) T Therefore: Macaulay Duration = 1PV (T×PV) = T Here: D = Macaulay duration of the bond T = Periods up to the maturity i = the ith time period C = payment of the coupon

Present value of zero coupon bond calculator. Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate Zero Coupon Bond - (Definition, Formula, Examples, Calculations) We can calculate the Present value by using the below-mentioned formula: Zero-Coupon Bond Value =Maturity Value/ (1+i)^ Number of Years You are free to use this image on your website, templates, etc, Please provide us with an attribution link Example Let's understand the concept of this Bond with the help of an example: Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 - (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ... Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. stablebread.com › calculators › present-valuePresent Value Annuity Factor (PVAF) Calculator | StableBread Zero Coupon Bond Value Calculator; Debt and Loans. After-Tax Cost of Debt Calculator; ... Calculator; Present Value of Annuity Continuous Compounding (PVACC) Calculator; How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

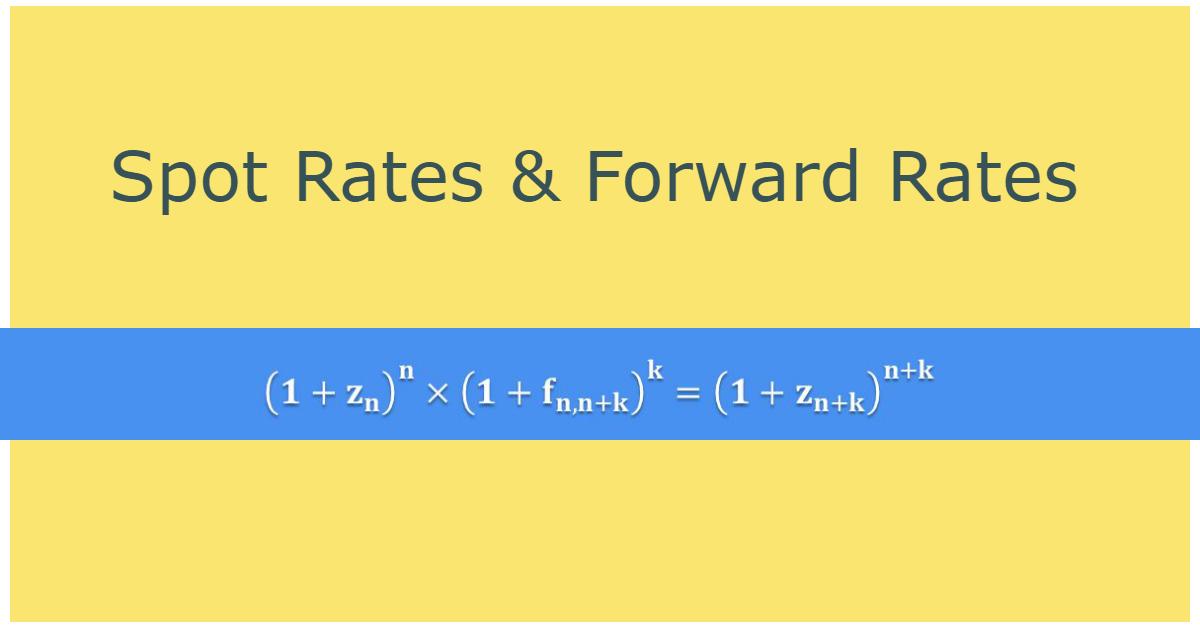

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes › Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Calculator - Nerd Counter If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). PV = PVT = Face Value (1+r) T Therefore: Macaulay Duration = 1PV (T×PV) = T Here: D = Macaulay duration of the bond T = Periods up to the maturity i = the ith time period C = payment of the coupon How to Calculate Bond Price in Excel (4 Simple Ways) Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples) Method 2: Calculating Bond Price Using Excel PV Function

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

Post a Comment for "38 present value of zero coupon bond calculator"