45 perpetual zero coupon bond

economics - perpetual bond that yields 0% - Personal Finance & Money ... 3 I've only heard of zero yield perpetual bond in the context of a trick interview question. They would ask how much would you pay for a perpetual zero coupon bond. The idea is you would pay zero for it since you don't get any coupons, and you never get your money back. Share Improve this answer answered Mar 6, 2016 at 13:26 mirage007 371 1 5 Calling Bitcoin a Ponzi Scheme is Lazy Thinking - Medium What are zero-coupon perpetual bonds? They are a type of bond that, in theory, combines the features of zero-coupon bonds and perpetual bonds. Zero-coupon bonds: Bonds that do not pay interest but are issued at a discount vs the nominal value of the bond. On maturity, the bond issuer pays back the nominal value of the bond.

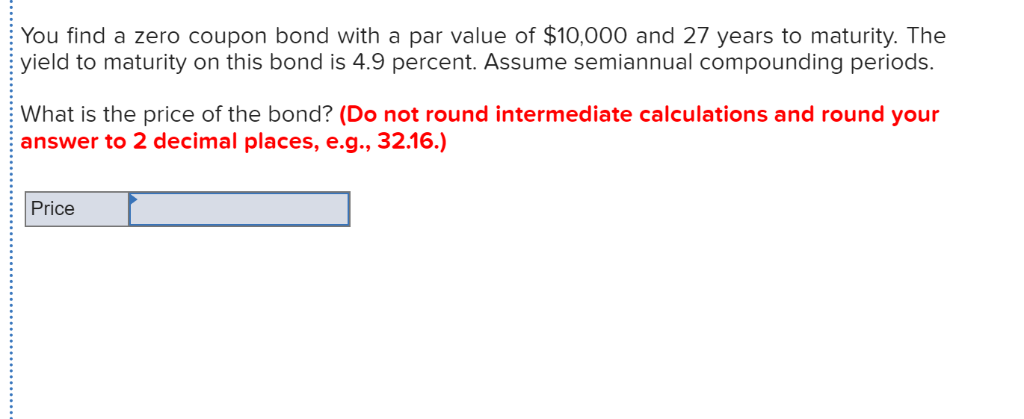

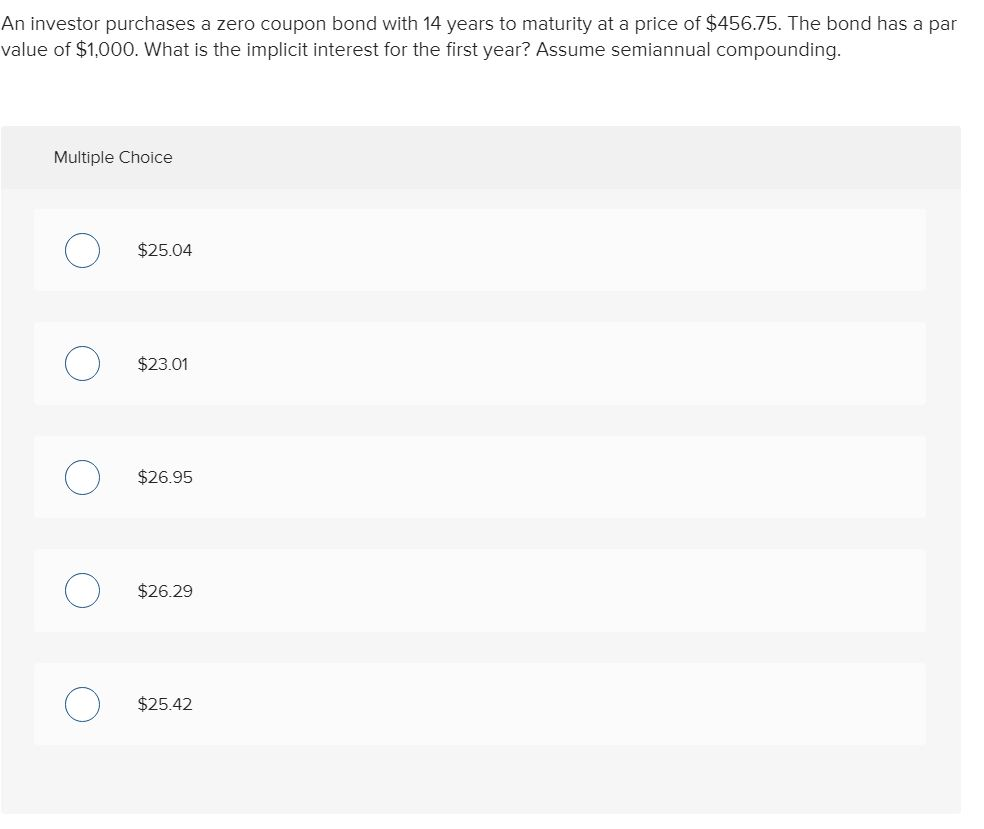

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than $100 in one year. By r...

Perpetual zero coupon bond

Is fiat currency the same as a perpetual zero coupon bond? But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. Quora User Bond Economics: Seriously, Money Is Not A Zero Coupon … 24.07.2016 · A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could … Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ...

Perpetual zero coupon bond. Zero-Coupon Bond - The Investors Book Coupon Payment Frequency: The intervals at which the payment of interest is made on the bonds is termed as coupon payment frequency. It is paid semi-annually or annually and even monthly or quarterly in some cases. Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term. Zero-coupon perpetual bonds? The government would issue these bonds specifically for the purposes of allowing the central bank to ‘balance’ its sovereign money liabilities. The zero-coupon perpetual bonds would not … Types of Bonds Perpetual bonds are bonds that don't have any pre specified maturity date. To compensate for the uncertainty involved with the receipt of principal, these bonds usually offer a higher rate of interest as compared to other comparable bonds having a pre-defined maturity. ... The return of a zero coupon bond or DDB can also be calculated using ... US should issue perpetual zero-coupon bonds - Breakingviews Everything you need to empower your workflow and enhance your enterprise data management. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology.

All the 21 Types of Bonds | General Features and Valuation | eFM A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Domestic bonds: India, Bonds 6.99% 15dec2051, INR IN0020210194 The corporate sector is represented by Convertible Bonds, Non-Convertible Debentures (NCDs), Perpetual, Zero Coupon Bonds, Masala bonds, External Commercial Borrowings (ECBs) and Foreign Currency Denominated Bonds (FCBs). Indian companies also issue Eurobonds, securitized debt instruments, foreign bonds as well as quasi debt instruments like ... What is the fair price of a perpetual zero-coupon bond? - Quora A zero coupon bond is a type of debt instrument that doesn't make a periodic interest payment but offers entire payment at maturity. Zero coupon bonds usually have a long maturity period and can take 10 or more years to pay out. These bonds are issued at a discount and repay at par value at maturity. Perpetual Bonds - Understanding the Basics • Coupon step-up: A coupon step-up feature in perpetual bonds enables the investor to receive an increase or step-up in the coupon rate as per a pre-set schedule. Coupon step-ups can be one-step or multi-step. One-step bonds have their coupon increased once throughout the bond's lifetime. Multi-step bonds have multiple increases through ...

investing - Why would zero-coupon perpetuity not be worthless (simple ... Why would a zero-coupon perpetuity not be worth exactly zero? Because its nominal value adds to the stock of debt of the issuer and so it is an option on recovery value - Michael Jezek, Deutsche Bank. This has a bit too much jargon for me to understand clearly, even after multi-tabbing investopedia. Question Perpetual Bond Definition - Investopedia Mar 19, 2020 · Present value = $10,000 / 0.04 = $250,000 Note that the present value of a perpetual bond is highly sensitive to the discount rate assumed since the payment is known as fact. For example, using the... Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha A zero-coupon perpetual bond would be revolutionary. "The hurdle to such extreme helicopter money measures is likely very high since they appear to be at odds with the spirit of Article 5 the... Helicopter Money and Zero Coupon Perpentual bonds - PGM Capital 18.09.2016 · A zero-coupon perpetual bond, allows a government to spend with impunity, since it would owe no interest, or would never have to pay the bond in any way. Zero coupon, no …

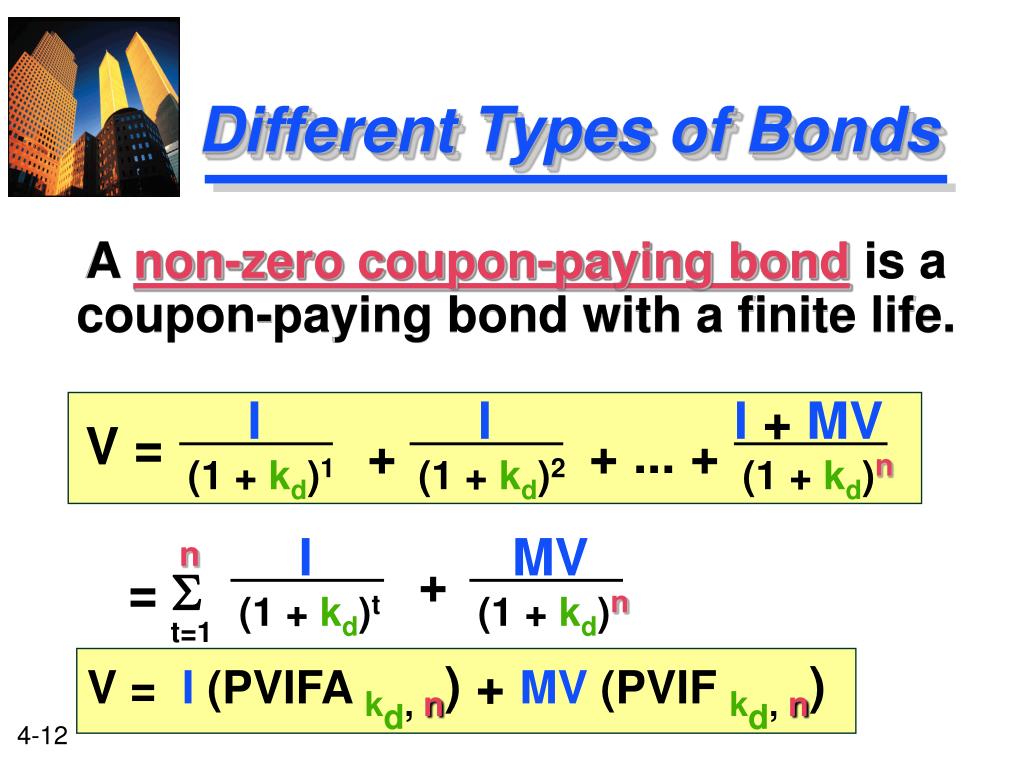

PDF Bonds - Wharton Finance » Pure discount or zero-coupon bonds - Pay no coupons prior to maturity. » Coupon bonds - Pay a stated coupon at periodic intervals prior to maturity. » Floating-rate bonds - Pay a variable coupon, reset periodically to a reference rate. zBonds without a balloon payment » Perpetual bonds - Pay a stated coupon at periodic intervals.

Zero-coupon bond - Wikipedia A zero coupon bond is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments …

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Types of Bonds | Boundless Finance | | Course Hero A zero-coupon bond (also called a " discount bond" or "deep discount bond") is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond.

PDF BOLI - The "Zero Coupon Perpetual Bond" - NFP Additional features of the BOLI "zero coupon perpetual bond" are: • This bond is often purchased with as much as a 65% discount, without undue credit risk. • The maturity value is essentially guaranteed by the issuer, insurance company, without essentially any default risk. • This is all tax-free per the Internal Revenue Code!

Impossible Finance — The Zero Coupon Perpetual Bond 21.02.2019 · The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. …

What are Perpetual Bonds? How to Value Them? - Fervent | Finance ... What are Perpetual Bonds. Firstly, what are perpetual bonds exactly? A Perpetual Bond is a fixed income security that pays a series of coupon payments (interest), forever. There is a theoretical possibility of a Perpetual Bond having a Par Value (aka Face Value) like regular bonds / plain vanilla bonds, but this is never paid.

Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation.

FWD Group Limited: Zero Coupon USD Perpetuals Indicated at 7% FWD's new bonds are subordinated perpetual securities, but will not pay coupons over the first five years, hence their "zero coupon" structure. The bonds are first callable five years after issuance (in June 2022), and if they're not called, the bonds will then start paying a semi-annual coupon.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years.

Bond Economics: Seriously, Money Is Not A Zero Coupon Perpetual A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice.

Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street...

Crypto: The Giant Ponzi Scam - Medium Bitcoin is a Ponzi scheme, multi-level marketing scheme, and pyramid scheme, all combined into one perpetual zero-coupon bond of societal, monetary, and environmental destruction. A reminder that...

Helicopter Money and Zero Coupon Perpentual bonds - PGM Capital PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

Domestic bonds: India, Bills 0% 8sep2022, INR (91D) IN002022X106 The corporate sector is represented by Convertible Bonds, Non-Convertible Debentures (NCDs), Perpetual, Zero Coupon Bonds, Masala bonds, External Commercial Borrowings (ECBs) and Foreign Currency Denominated Bonds (FCBs). Indian companies also issue Eurobonds, securitized debt instruments, foreign bonds as well as quasi debt instruments like ...

What is the fair price of a perpetual zero-coupon bond? - Quora A zero coupon bond is a type of debt instrument that doesn't make a periodic interest payment but offers entire payment at maturity. Zero coupon bonds usually have a long maturity period …

Impossible Finance — The Zero Coupon Perpetual Bond Feb 21, 2019 · The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. infinity This is a very simple calculation for a Zero...

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

Post a Comment for "45 perpetual zero coupon bond"