42 what is a coupon payment on a bond

What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates. WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

What is a coupon payment on a bond

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ... Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What is a coupon payment on a bond. Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value. Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. What is a Coupon Payment? - Definition | Meaning | Example Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

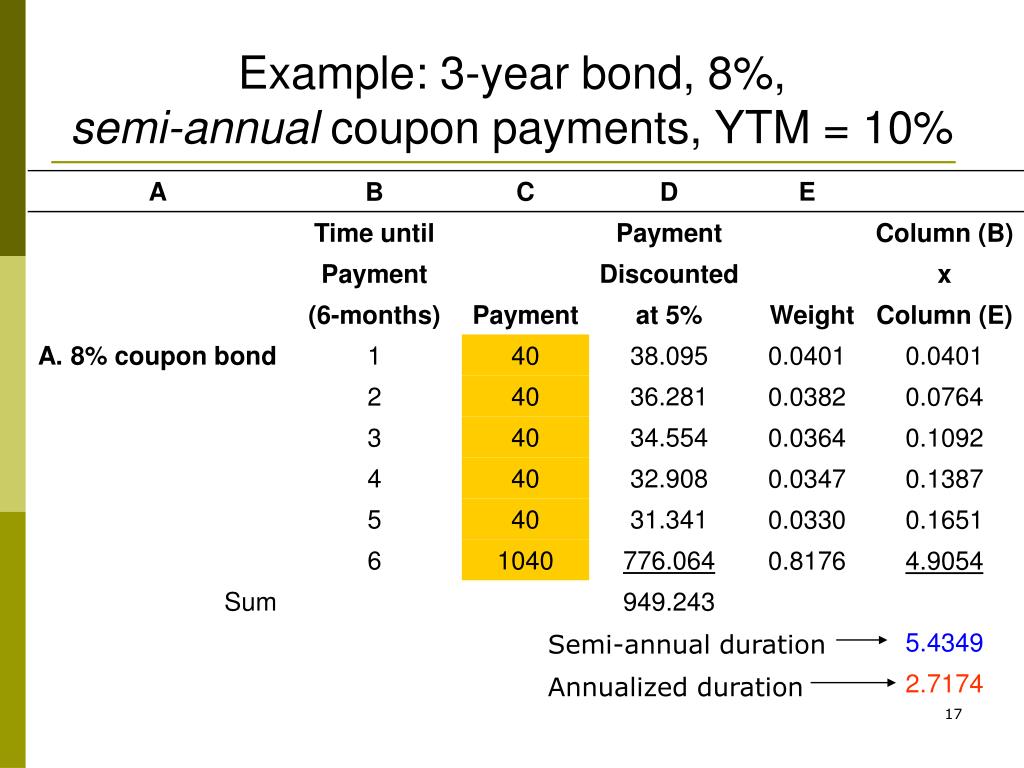

Payment in Kind Bonds (PIK): What Are They and How PIK Works? A Payment-in-kind bond is a type of bond that makes coupon payments in the form of bonds or any other security. It does not pay coupons in the form of cash. The PIK bonds either do not make any cash payments or make cash payments in conjunction with in-kind assets. For instance, in the early years of a PIK, the investors may receive coupon ... What Is Coupon Rate and How Do You Calculate It? What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail. An 8% coupon bond makes coupon payments twice a year | Chegg.com What is the bond's full price if there are 183 days between these coupons, and 100 days have passed since the last coupon payment and the sale of the bond? Please provide your answer, in Rands (R), correct to; Question: An 8% coupon bond makes coupon payments twice a year and is trading at a YTM of 6%. When the bond is sold, four coupon ...

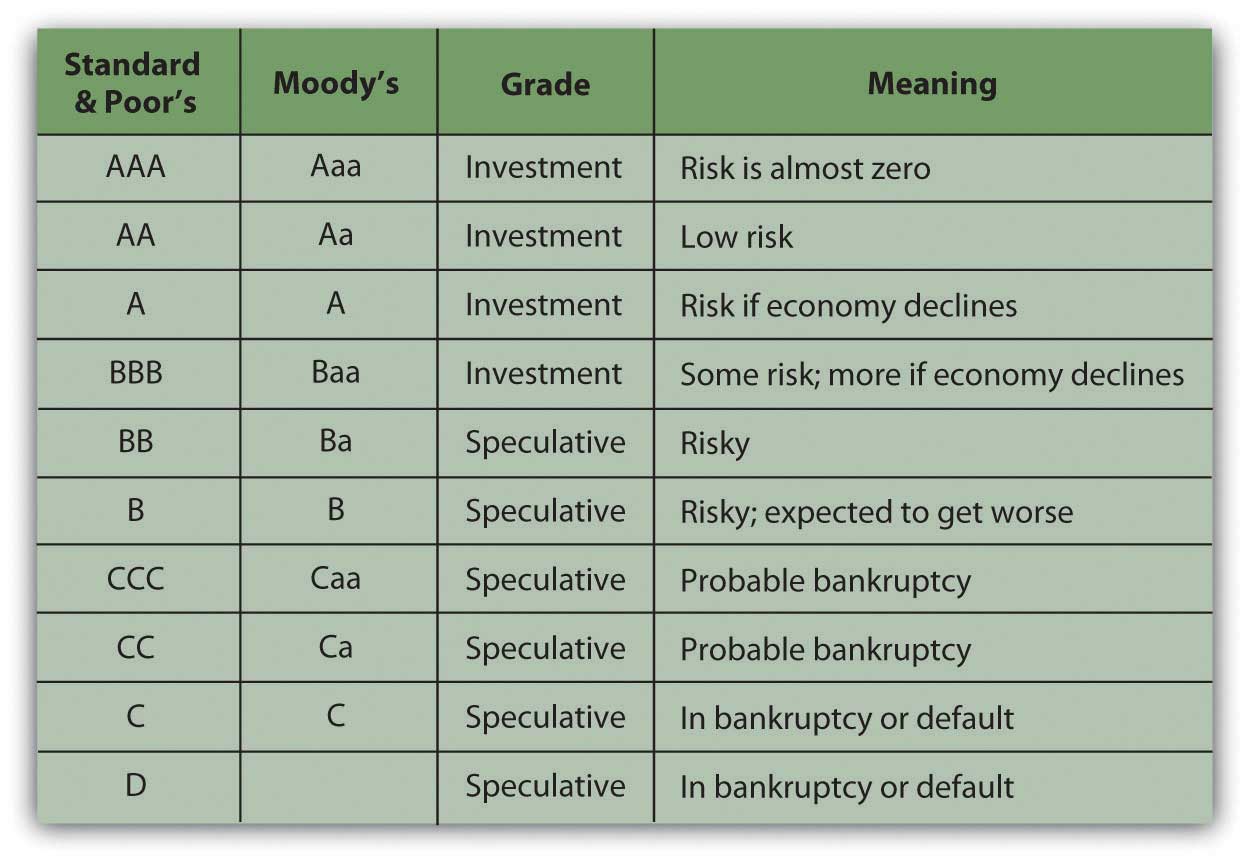

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it. Solved What is the coupon payment of a bond with a face | Chegg.com What is the coupon payment of a bond with a face value of $1,000 and an annual interest rate of 4%? Coupon payment is equal to $ (Enter your response as an integer.) Question : What is the coupon payment of a bond with a face value of $1,000 and an annual interest rate of 4%? Junk Bonds: Definition & Benefit to Investors | Seeking Alpha For example, a bond with a face value of $1,000 and an annual coupon interest of 10% will pay a coupon payment of $1,000 × 10% = $100 per year. At maturity, the bond pays its last coupon payment ... How to Calculate a Coupon Payment: 7 Steps (with Pictures) Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies.

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

Coupon Bond Formula | Examples with Excel Template The term "coupon" refers to the periodic interest payment received by bondholders and bonds that make such payments are known as coupon bonds. Typically, the coupon is expressed as a percentage of the par value of the bond. The formula for coupon bond means price determination of the bond that pays coupon and it is done by discounting the ...

What Are Coupon Payments? - ClydeBank Media Coupon payment is the periodic payment of interest by a bond issuer to a bondholder. Coupon payment is not to be confused with stock dividend payment—the two are distinct in a few ways. When an investor or trader purchases shares of stock in a company, they are purchasing the rights to a portion of that company's profits.

What is the difference between coupons and dividends? In fact, if the coupons are not paid on time by the borrower it can take the default procedure, bankruptcy. There are fixed rate coupons and floating rate coupons. There are also zero coupon bonds in which the yield to maturity of the bond is cashed by calculating the difference between the subscription price and the redemption price.

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

Answered: Exactly 3 years ago, you bought a bond… | bartleby ASK AN EXPERT. Business Finance Q&A Library Exactly 3 years ago, you bought a bond for $925. You just received your 6th coupon payment of $30, and you then immediately sold the bond for $870. What was your realized yield on this investment, stated as an effective annual rate (EAR)? Exactly 3 years ago, you bought a bond for $925.

/GettyImages-926128998-9f97e353e3d240efbbbd03fa3205d190.jpg)

Post a Comment for "42 what is a coupon payment on a bond"