39 treasury bill coupon rate

91 Day T Bill Treasury Rate - Bankrate 91-day T-bill auction avg disc rate. 0.89. 0.61. 0.03. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a discount ... US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: 1000.00 5000.00 10000.00 25000.00 50000.00 100000.00 1000000.00

Treasury Bills (T-Bills) Definition As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face...

Treasury bill coupon rate

U.S. 2 Year Treasury Note Overview - MarketWatch 2-year Treasury rate hits lowest level since March even after a surge in U.S. wholesale prices Apr. 13, 2022 at 4:11 p.m. ET by William Watts 2-year Treasury yield up 1.3 basis points at 2.397% India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Treasury Bill Rates - Bank of Ghana Treasury Bill Rates. Treasury rates. Home / Treasury and the Markets / Treasury Bill Rates. Treasury Bill Rates. Issue Date Tender Security Type Discount Rate Interest Rate ; Issue Date Tender Security Type Discount Rate Interest Rate; 25 Apr 2022: 1795: 364 DAY BILL: 16.4393: 19.6735: 25 Apr 2022: 1795: 91 DAY BILL ...

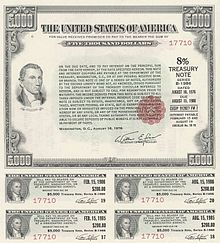

Treasury bill coupon rate. PDF Price, Yield and Rate Calculations for a Treasury Bill ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate remains fixed over the lifetime of the bond, while the yield-to-maturity is bound to change. When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals ... Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate. United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular weekly T-bills are commonly issued with maturity dates of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks.

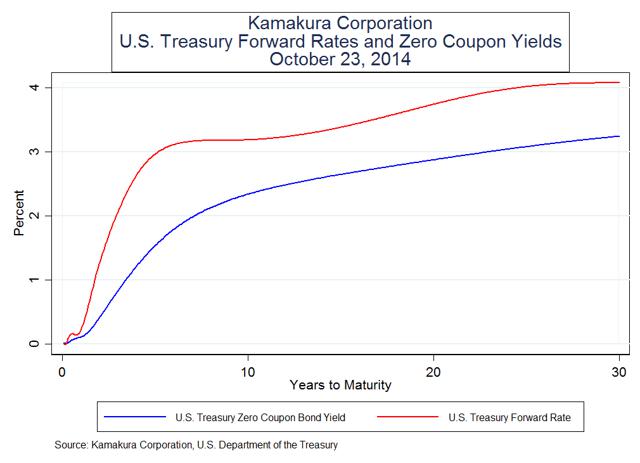

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Monthly Average: 2008-2012 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2003-2007 TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2008-2012 Treasury Bills vs Bonds | Top 5 Differences (with ... Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more: T-bills do not pay any coupon. How Are Treasury Bill Interest Rates Determined? The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value... Treasury Bills - Types, Features and Advantages of ... Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding.

U.S. 1 Year Treasury Bill Overview - MarketWatch 2-year Treasury rate retakes 10-year high after Powell's Senate testimony Jul. 17, 2018 at 4:39 p.m. ET by Sunny Oh Treasury yields rise after retail sales help affirm U.S. economic strength U.S. 5 Year Treasury Note Overview - MarketWatch Five-year Treasury yield rises above 2.2%, surpassing 10-year yield's level and inverting fresh part of the curve after Fed's decision. Mar. 16, 2022 at 2:55 p.m. ET by Vivien Lou Chen. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. United States Treasury Bills: 26-week - High rate | Moody ... Treasury Bills: 26-week - High rate for United States from U.S. Bureau of Public Debt for the Treasury auctions - 13- and 26-week (91- and 182-day) T-Bills release. This page provides forecast and historical data, charts, statistics, news and updates for United States Treasury Bills: 26-week - High rate.

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

Resource Center | U.S. Department of the Treasury Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Receipts & Outlays. Monthly Treasury Statement. Daily Treasury Statement. How Your Money Is Spent. USAspending.gov.

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

Treasury Rates, Interest Rates, Yields - Barchart.com Treasury Rates. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. Click on any Rate to view a detailed quote. Treasury bills, notes and bonds are sold by the U.S. Treasury Department.

Post a Comment for "39 treasury bill coupon rate"